The capitalist world-economy is a degree of monopoly system because capitalists seek to minimize market competition through “competitive advantage.” Building upon Braudel and Wallerstein (1983, pp. 17, 29, 33-34, 55), I contend that the struggle for degrees of monopoly is an historical driving force of capitalism. However, few firms capture high degrees of monopoly. The system is sharply gradational, following a steep curve of degrees of monopoly. The new international division of labor cut costs through corporate exploitation of small peripheral capitalist subordinates to whom elements of the production process are outsourced at much lower costs than those processes could be completed in the core (Clelland, 2014). Through oligopolistic practices, the multinational corporation “adds value” at nodes of a commodity chain through underpayment of subordinate capitalists. Sau (1982, p. 139) observes that superprofits accrue to the most powerful capitalists because “the bourgeoisie is no longer a homogeneous class; it is split into two sectors, namely monopolist and non-monopolist.” Thus, the capitalist controlling greater degrees of monopoly cuts costs by “erod[ing] the profits that accrue to the non-monopolist bourgeoisie.” As a result, most capitalists who sell other capitalists intermediary components in supply chains are subjected to exploitation by the minority of capitalists in the anti-market sphere who hold strong degrees of monopoly. In the contemporary world, degree of monopoly is not primarily based on the control of territories, but on access to cheaper labor, resources and production costs.

A multinational corporation constructs strong degrees of monopoly through several imperialistic strategies, including: (a) a strong degree of influence in international development organizations that regulate trade or set global policy (Ayers, 2009), (b) privileged ties to the states in which it operates, often utilizing corruption of public officials (Koves, 2009), (c) development of innovations and control over transnational intellectual property rights (Perelman, 2004), (d) global control over product distribution and marketing, (e) governance of commodity chains through oligopolistic subcontracting relations with suppliers, (f) externalization of costs to suppliers, to communities and to workers, and (g) maximization of dark value drains (Clelland, 2012, 2013, 2014).

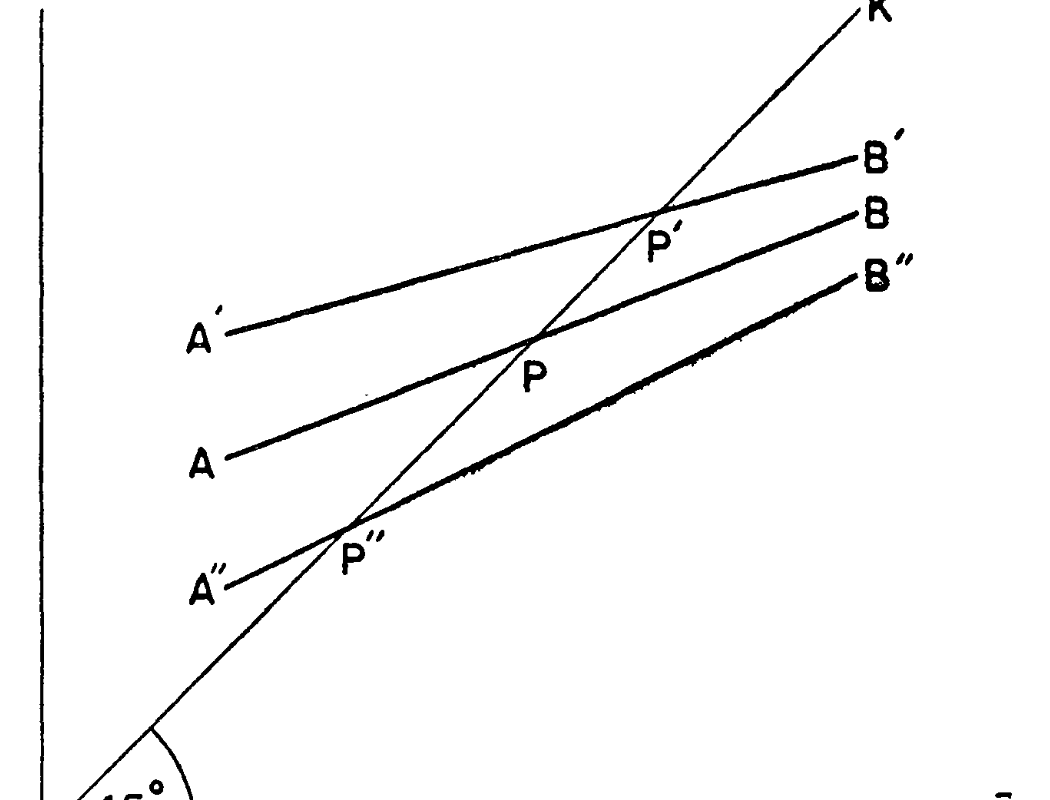

The logic of imperialism that is built into capitalism is the search for lower costs through which capitalists attain a more monopolistic position. To capture surpluses, capitalists are compelled to identify and integrate locations where they can take advantage of the lowest costs of production to generate commodities for marketing in areas where prices are highest. While they are sought by all participants in commodity chains, actual capture is related to the capitalist’s hierarchical position in the chain. This structure is highly dependent upon degree of monopsony, the ability to control “mark-downs” in the costs of inputs. At each node, every firm attempts to attain power over markups by constraining its supply costs. Within any node, full capture of the surplus is constrained by the relative monopsony power of the buyer (Robinson, 1993). In order to cut costs deeper than the competition, each firm tries to externalize the least profitable elements of production and circulation to suppliers and distributors who face more intense competition. The firm to which production is outsourced “sells semi-dear,” by passing on part of its potential surplus in the form of a reduced price, allowing the capitalist with a high degree of monopoly to “buy cheap.” Obviously, this relationship is not between equals (as in the abstract model of neoclassical economics). Rather, the relationship is one of surplus extraction through unequal exchange, for capitalists construct their degrees of monopoly through exploitation of producers and sellers who hold less market power. Lead firms increasingly organize and govern commodity chains as degree of monopsony chains and mark-down chains in order to maximize their capture of value. As a result, oligopoly plays a key role in sustaining wage differential on a global scale (Communist Working Group 1986). I am convinced that the “global value chain” approach is mistaken in its emphasis on value added. The whole point of the chain is value capture, especially for those capitalists who have obtained a high degree of monopoly.

Each point of linkage in a commodity chain is a relationship of upward surplus drain, typically through transactions among capitalist firms. As a commodity moves up the chain, each capitalist usually has a greater “degree of monopoly” than those below. That degree of monopoly is reflected in the capitalist’s ability to constrain the transmission of costs of production from below. Technically, this is a degree of oligopsony in which a few buyers control prices. The large wholesaler or retailer at the end of the chain may hold a true degree of monopoly through control of sales markets. As a general rule, labor costs, resource prices, profit rates and rents increase with movement up the chain, with a portion of the surplus collected at each node being passed to the node above. At each node, full realization of the potential surplus is constrained by the relative monopsony power of the buyer. In order to “buy cheap,” the capitalist lowers costs by externalizing part of the production process to subordinate capitalists who are cheaper producers. Mainstream economists are quite aware that the best strategy that a firm can follow to out-perform other competitive firms is “overall cost leadership,” i.e., to cut costs of production deeper than the competition (Porter, 1980, pp. 35-36). Thus, the firm that is higher in the chain cuts costs by outsourcing part of its internal production. The capitalist lower in the chain passes on part of the potential surplus in the form of a reduced price, allowing the capitalist with a degree of monopoly to “buy cheap.”

References Cited

- Ayers, A. 2009. “Imperial Liberties: Democratisation and Governance in the ‘New’ Imperial Order.” Political Studies LVII, 1–27.

- Communist Working Group. 1986. Unequal Exchange and the Prospects of Socialism (Copenhagen: Manifest Press).

- Koves, M. 2004. “Fascism in the Age of Global Capitalism,” Social Scientist XXXII, 36-71. Perelman, M. 2004. Steal This Idea: Intellectual Property and Confiscation of Creativity (London: Palgrave-Macmillan).

- Porter, Michael. 1980. Competitive Strategy. New York: Free Press.

- Robinson, Joan. 1993. The Economics of Imperfect Competition (London: Macmillan).

- Sau, R. 1985. Unequal Exchange, Imperialism and Underdevelopment: An Essay on the Political Economy of World Capitalism (New Delhi: Oxford University Press).

- Wallerstein, Immanuel. 1983. Historical Capitalism. London: Verso.